National Public Relations Public Radio (NPR) has a piece that tries to explain how paying off the federal debt ended poorly for the United States. I’m not quite sure what their angle is but it appears to be an argument against ridding ourselves of the yoke of our national debt:

That was the one time in U.S. history when the country was debt free. It lasted exactly one year.

By 1837, the country would be in panic and headed into a massive depression. We’ll get to that, but first let’s figure out how Andrew Jackson did the impossible.

What? Paying off the national debt will lead to a depression! Oh no, we need to make the debt bigger! Due to a failure of logic it’s pretty easy to see the depression that followed paying off the federal debt was due to the use of fiat money.

When Jackson took office, the national debt was about $58 million. Six years later, it was all gone. Paid off. And the government was actually running a surplus, taking in more money than it was spending.

Damn, if it wasn’t for that whole massacring American Indians Andrew Jackson may actually be on the very short list of presidents I respect.

That created a new problem: What to do with all that surplus money?

Jackson had already killed off the national bank (which he hated more than debt). So he couldn’t put the money there. He decided to divide the money among the states.

Um… I don’t think the author understands what a national bank is. A national bank isn’t some place for the federal government to place its money so that it can be loaned out to other countries as banks we interact with daily are. National banks exist simply to control the supply of money without having to deal with that pesky free market that prevents easy expansion of the money supply. What a national bank does is print money and loan out that money (usually to other banks) to expand the supply of money and recalls loans to contract the supply of money. Through this convoluted process the national bank attempts to control inflation but in actuality causes inflation as the money supply is only expanded due to the government wanting more and more money to spend on frivolous projects.

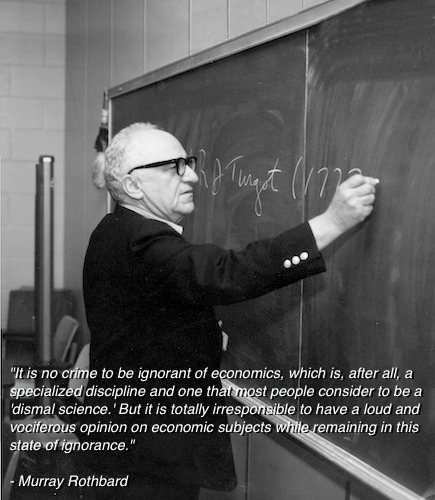

Thus eliminating the Second National Bank didn’t prevent the federal government from storing the surplus of money, that statement is just idiotic. Fuck it, take it away Rothbard:

The state banks went a little crazy. They were printing massive amounts of money. The land bubble was out of control.

Exactly what I said above, when government is given the power to expand and contract the money supply they only expand it. Fiat money systems are bad m’kay.

Andrew Jackson tried to slow everything down by requiring that all government land sales needed to be done with gold or silver. Bad idea.

Please, explain to me how that was a bad idea.

“It was a huge crash, and the beginning of the longest depression in American history,” Gordon says. “It actually lasted six years before the economy began to grow again.”

That crash is what we would call a market correction. In essence the value of land was much higher than the market could bear due to government distortion (printing money to buy up land, thus artificially increasing demand and therefore value). This is exactly what happened with the housing market and is currently happening with the education market.

By demanding all land purchases be made in silver and goal Jackson was saying the states had to give something of value instead of worthless paper they could simply print up willy nilly. The crash wasn’t due to the requirement of using gold and silver, it was a demonstration of the fact that land wasn’t worth what people were selling it for.

Let’s use another example because I love examples. Due to some fortune vendors have decided to accept paper notes you print off in exchange for goods. At first you decide you want to maintain your purchasing power so you only print 100 notes. You also don’t produce anything besides these notes so at one point you run out of these notes and come to a crossroad; in one direction you have to get a job and start producing while in the other direction you simply print more of these notes. Being lazy you go with the easy method of print more notes. Seeing how easy this really is you start printing vast numbers of these notes and buying up as much product as you can. Unfortunately the massive influx of new notes has made them easier to come by, which fills demand, which reduces the value of each individual note (supply and demand). As each note is worth less value people who have them are able to buy less, unless they control the printing press and can simply punch up more paper!

Inflation is a delayed phenomenon. The first receiver of the printed money has vast purchasing power because the notes haven’t entered the market yet and thus haven’t increase the supply (and therefore reduce demand). Therefore the first person to receive these new notes is able to buy products at their current market value at which point the notes enter circulation. Now that those notes are in circulation the supply has increase and thus the individual value of each note is reduced.

Gold and silver can’t simply be printed up and they’re both used in actual manufacturing so the supply of money stays relatively stable. Thus gold and silver (which aren’t the only commodities you can use for money) are good to use for money as their supply remains relatively constant, which keeps inflation in check.

Now you know why fiat money is bad.