Democracy is two wolves and a lamb voting on what to have for lunch. Liberty is a well-armed lamb contesting the vote.

That quote is usually misattributed to Thomas Jefferson but who first said it matters not, the statement provides an excellent image that explains why democracy is not a just system. During any of the occupation general assemblies you usually find something saying, “Democracy is messy!” or, “This is what democracy looks like!” While the speakers say those phrases with a positive connotation I simply sigh when I hear them. Those phrases are usually said after some minor issue is raised during the general assembly and an hour of debate, screaming, and placating have finally beaten the majority down enough that they vote in favor of whatever was proposed just to get things moving along.

Democracy is an immoral system because it gives the majority power over the minority. It allows one group to use coercion or outright violence against another group and call the action just. An excellent article describing this fact was posted yesterday on Mises Daily:

Wealth redistribution, therefore, is theft. It is the taking by force from one group in order to give to another. Force is involved because anyone who fails to pay assessed taxes — confiscatory taxes that mostly go directly into someone else’s pockets — will be put in prison. People from whom money is taken have not usually voted for this action,[1] but those who wanted to receive others’ money usually have voted to take it from them. Many socialists will dispute this and argue that most people want to pay the amount of taxes they pay. This implies, for example, that when the government doubled the tax rate during the Great Depression, people, coincidentally, simultaneously wanted to voluntarily pay double the amount of income tax. It implies that when marginal tax rates reached 90 percent, people truly wanted to work and hand over 90 percent of their marginal earnings. The argument is too weak to take seriously. Besides, if most people want to pay all the taxes they pay, socialists will have no problem switching the payment of taxes from being required by law to being voluntary.[2]

One of the outcomes of democracy is always wealth redistribution. That is a majority of poorer people vote in favor of stealing the minority or richer individual’s wealth. This becomes very evident when you look at the language and income tax brakets. The occupiers call themselves the 99% and imply the 1% are the enemy. What composes this 1% varies from person to person but it’s usually the top 1% of income earners. Many calling themselves the 99% demand that wealth or assets be taken from the 1% and distributed amongst the majority group.

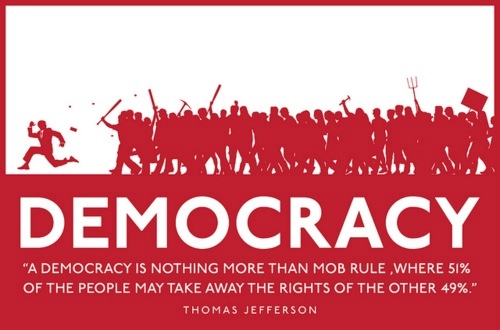

When you look at income tax brakets you’ll notice they get progressively higher as income increases but a smaller minority composes each higher income tax braket. It’s very easy to get somebody to vote in favor of stealing from another when the voter perceives the target as being wealthier. While somebody making $50,000 a year is unlikely to vote in favor of stealing money from those making $50,000 a year he very well may vote in favor of redistributing the wealth of somebody who makes $1,000,000 a year. This is what democracy looks like:

The last statement in the quoted paragraph holds important truth as well. If people truly wanted to pay taxes then there should be no need for force them through the threat of prison. I would bet if we repealed laws making the payment of taxes mandatory a large majority of people would stop paying taxes. Knowing this it seems absurd to believe a majority of the population agree that paying taxes is something they want to do voluntarily and therefore democracy has failed in this case to express the desires of even the majority. What a majority of people really want is a proxy to perform the act of theft for them which is what taxation accomplishes and what actually democracy gets us.

Those demanding other peoples’ money also like to control the language using such phrases as, “tax breaks for the rich” to imply the rich are somehow being gifted instead of simply having less stolen from them:

In dollar amounts, households in the lowest-earning quintile in 2004 received about $31,185 more in government spending than they paid in taxes, while the middle quintile received $6,424 more than they paid. The top quintiles, however, paid $48,449 more in taxes than they received in government spending. In the aggregate, the top 40 percent of income-earning households paid roughly $1.03 trillion more in total taxes than they received in government spending, while the bottom 60 percent received $1.53 trillion more in government spending than they paid in taxes (the difference being the amount spent by government in excess of what it brought in — an excess mostly financed by the future top income earners). This is wealth redistribution.

We can see from these statistics how absurd is the phrase “tax breaks for the rich.” The rich do indeed benefit most from tax breaks because of the fact that they pay most taxes. Tax breaks are the giving back to the rich some of the money that was previously taken from them. Yet socialists call this redistribution from the poor to the wealthy! In other words, if the poor aren’t allowed to receive as much of others’ incomes as before, and the rich are allowed to keep more of their income, then, in the eyes of socialists, the rich are taking from the poor. This is like saying that a thief who must return a woman’s purse after getting caught stealing it is redistributing money from himself to her.

When you are willing to demand the money of others you seldom are willing to express your idea for what it is, theft. Even if we claim the act of wealth redistribution for what it is the thieves try justifying the act as being moral in this specific case:

I conclude that society does not really care about morals. They care about what’s best for them, defining terms in different ways in different situations, to fit their own personal or ideological agenda. Socialists condemn the businessman who becomes rich by pleasing others and providing jobs for workers and who harmed no one else in the process. But socialists claim that workers (and nonworkers) who were paid the full value of their work by the businessman but still choose government force to make him pay more, are innocent, righteous, and deserve “social justice.”

Trying to argue with an opponent who is willing to justify acts as being moral depending on whether or not the acts benefit him is impossible. I do my damnedest to ensure what I advocate complies with my moral and ethical beliefs which is why you never hear me advocating higher taxes on anybody even though I would likely benefit from increasing taxes on those earning more than me. Being consistent is important in my eyes because inconsistency leads to cognitive dissonance which makes presenting your argument difficult as it can be shot down using your own beliefs and statements.

Another fact to take away from this article is that voting for government to improve your life always leads to the opposite:

Suppose your family decided to start a business. You invest time, sweat, money, and opportunity costs in creating a new product or service. Your company’s product did not previously exist, but you made it available for others, without harming or forcing anyone to exchange their income for the product. After some years, your product becomes so popular that your family has now become wealthy through voluntary exchange. Others, who engage in forceful, not voluntary, exchange, in their jealousy, use the government to regulate you. They force you to sell part of your company to your competitors (antitrust legislation) who are not able to compete as efficiently and effectively; they force you to pay your workers more than you can afford (union legislation); they force you to sell your product for a lower price than the market demands and for a lower price than you would like (price controls); they force you to produce in a way that pollutes less but raises your costs and reduces your output (EPA legislation); they then impose a “windfall-profits tax” because they think you’re earning too much money this year. Your company started out being your private property that benefited society, but then society — through government regulation — took control of it and sucked it dry. Now your family earns less, your workers earn less, and less of your product is available to consumers, and at a higher price. The consumers got what they voted for. Voting for the government to improve one’s life almost always results in the opposite.

People who earn their wealth by providing a service or product people desire should never be punished. Punishing the productive only demotivates them from trying to continue serving our society in grand new ways. If I knew producing my new product would better society but ultimately lead to my demise as others simply took the product of my mind and labor I wouldn’t be very motivated to invest my wealth and labor in developing the product.

Those who demand money be stolen from the “rich” and given to the “poor” need to stop. What they are really advocating is theft and I am willing to bet money that those same people would not support me walking into their home and stealing their property. Taxation is theft by proxy just as calling the police is violence by proxy. In both cases the person calling on the government isn’t asking for means or protection, they’re asking for a third-party to perform acts of theft and violence. Individuals advocating taxation should be fine with allowing others to come into their home and steal their property just as those who demand guns be taken away from others because they’re violent devices shouldn’t call the police when somebody breaks into their home.